WALKING AWAY FROM MY DREAMS!

I keep on hearing what I never said

Without reasons I am weaving dreams

Know not whose evil eyes have caught me

No place for me in this city any more

Walking away from my dreams I suffer

The pain now is more than it used to be before

I once again make a promise to myself

May the silent gaze remain speechless

My lips do always tremble while talking

Inexpressible are the secrets of the heart

I am on a journey without any companion

I kept on going far and near

Once again she comes into my sight

The smoke from past still pricks my eyes

Why the same world is forming again

Far from my reach, beyond my knowing.

WORDS IN MY HEART!

I am waiting for your benign glance

Though I am sitting through dreams

While the night remains restless

The words in my heart escape from lips

How many nights I‘ll awake like this

My heart‘ll be content with this thought

That my well-being ‘ll become yours

As the restful night ‘ll remain restless

I am still waiting for your benign glance.

THE SIMPLE CONFESSION!

I have been waiting for you for long

The night is picking up the dreams

How long I should hold on to both lips

The words my heart wishes to speak

How many sleepless nights I shall pass

Before I do place the simple confession

I like you and I do love you the most

My heart will be pleased with the thought

Finally, I wonder if you feel the way I feel

So restless is the night of tranquility

I have been waiting for you for long.

AS A MUTE WITNESS!

My heart lets me move elsewhere

Woes of world have filled my soul

Looks for me now here and there

Where no one is battered by woes

Sans twinkling stars of false hopes

What use of autumns for me now

Which freeze the buds of my soul

Which renew all of my old wounds

Some do shed their genuine tears

Some flee turning face in despair

Someone’s world is badly looted

The earth as a mute witness stands

The ruthless sky too maintains silence.

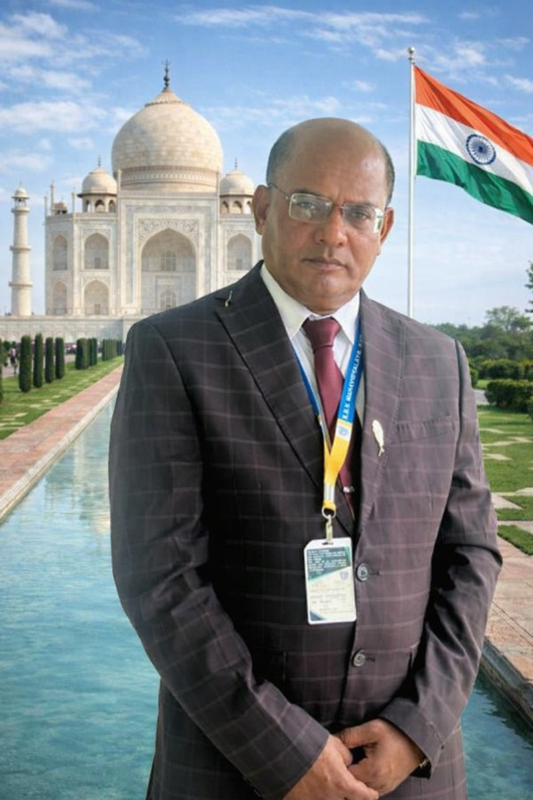

Sahitya Ratnakar Dr Prasana Kumar Dalai.

(DOB 07/06/1973) is a passionate Indian Author-cum- bilingual poet while a tremendous Asst Professor of English by profession in the Ganjam district of Odisha.He is an accomplished source of inspiration for young generation of India .His free verse on Romantic and melancholic poems appreciated by everyone. He belongs to a small typical village Nandiagada of Ganjam District,the state of Odisha.After schooling he studied intermediate and Graduated In Kabisurjya Baladev vigyan Mahavidyalaya then M A in English from Berhampur University PhD in language and literature and D.litt from Colombian poetic house from South America.

He promotes his specific writings around the world literature and trades with multiple stems that are related to current issues based on his observation and experiences that needs urgent attention. He is an award-winning writer who has achieved various laurels from the circle of writing worldwide. His free verse poems not only inspire young readers but also the ready of current time. His poetic symbol is right now inspiring others, some of which are appreciated by laurels of India and across the world. Many of his poems been translated in different Indian languages and got global appreciation. Lots of well wishes for his upcoming writings and success in future.

He is an award-winning poet author of many best seller books. Recently he is awarded Rabindra nath Tagore and Gujarat Sahitya Academy for the year 2022 from Motivational Strips . Jaidev Puraskar from Kavita Minar Badamba Cuttack A gold medal from world union of poets France & winner Of Rahim Karims world literary prize 2023.The government of Odisha Higher Education Department appointed him as a president to Governing body of Padmashree Dr Ghanashyam Mishra Sanskrit Degree College, Kabisurjyanagar. Winner of ” HYPERPOEM ” GUNIESS WORLD RECORD 2023.Recently he was awarded from SABDA literary Festival at Assam. Highest literary honour from Peru contributing world literature 2024.Prestigious Cesar Vellejo award 2024 & Highest literary honour from Peru. Director at Samrat Educational charitable Trust Berhampur, Ganjam Odisha.

Vicedomini of world union of poets Italy. UHE awarded him prestigious Golden Eagle award for the contribution of world literature 2025.

Completed 257 Epistolary poetry with Kristy Raines USA.

Bharat Seva Ratna National award 2025, International Glory award from Manam Foundation Hyderabad Telengana. On the eve of 79 Independence Day got Rashtra Ratna award & Maa Bharati seva Sammana. 2025.Received Doctorate in Humanity and literature from Theophany university Haiti with UNESCO, AEADO and leaders of autonomy international. The prince of Crimea and the Golden Horde from the house of Genghis Khan given prestigious “Honorary Bey”

Received Sahitya Ratnakar from New Delhi 2025, Honorary Doctorate from RMF University collaborated with east and west university Florida United States Of America on the eve of International Peace Day. Prestigious THE CONDOR OF ANDES from UHE Mexico 2025. PRESTIGIOUS DOCTORATE from VICTORIA UNIVERSITY OF CULTURE AND WORLD PEACE 2025. Nominated for Padmashree 2025. Three-time Gold from the world Union of Poets France. Doctorate from Theophany university Haiti contribution for the world literature 2025.Conferred title SAHITYA RATNAKAR from New Delhi.Dr Mayadhar Mansigh Saraswat Samman 2025.Doctorate in Gandhian Philosophy,Peace and Humanity 2025.

Doctorate from VICTORIA University for peace 2026.UHE of Peru appointed as a world ambassador for the peace and justice 2026.Valiant of Nation award 2026 on the eve of Subash Chandra Bose 129 birth anniversary.

INTERNATIONAL BOOKS

1.Psalm of the Soul, 2. Rise of New Dawn, 3. Secret Of Torment, 4.Everything I Never Told You.,5.Vision Of Life National Library Kolkata, 6.100 Shadows of Dream, 7.Timeless Anguish, 8. Voice of Silence, 9.I Cross my Heart from East to West, and epistolary poetry with Kristy Raines, published in USA.